How to Find Your First Investor (and Make a Great Pitch Deck at the Same Time)

Part 3 of the “How to Raise a Pre-Seed Round” Series

This week we’re going to get into Part 3 of the “How to Raise a Pre-Seed Round” Series: How to Find Your First Investor (and Make a Great Pitch Deck at the Same Time).

How to Raise a Pre-Seed Round Series

🔍 Part 3: How to Find Your First Investor (this post)

You’ve decided that it’s time to raise and know how much you want to raise — great! The next big challenge is finding investors and making a great pitch deck to tell your company’s story.

Often, entrepreneurs view finding investors and making a deck as separate tasks. But, I think it’s actually best to tackle them at the same time — here’s how.

Making your deck

First off, do decks even matter? Here are a few reasons why I think investing time in a solid deck is worth it.

A deck is how you get calls and prevent unnecessary calls. Scheduling and attending calls is time-consuming for everyone involved. Let’s say it takes about 15 minutes to schedule a call and then 30 minutes for the call. A good way to make the call worth their time and your time is to have a simple but compelling deck. Many investors may not even schedule a call if you don’t have a deck because they don’t want to waste their time.

A deck allows you to easily use your network. Decks are straightforward to share and easily understood. A solid deck will make your friends, investors, and advisors much more likely to reach out to investors who may be interested.

Investors view decks as an important test. Investors view decks as a proxy for: 1) Do you understand what you’re doing and 2) Can you clearly communicate what you’re doing. Founders need to sell, recruit, and raise more money. If investors view your communication skills as lacking, they may see it as a risk to the business.

Start with a story

To get started, an approach that I’ve found helpful is to think about your business as a short one-paragraph story with a beginning, middle, and end.

Cover the topics of the problem, solution, market size, team, and traction in your story. Consider adding a sentence on competition, business model, why now, and use of funds for a longer deck. For example, let’s pretend you’re the founder of Uber; your one-paragraph story may look something like this:

UberCab is a next-generation car service. We help people go places faster and cheaper than taxis. We help idle black car drivers make more money. We do this in a highly efficient way by connecting them automatically using new GPS-enabled smartphone technology. The taxi and limo industry is $4.2B and growing. Our team has startup and industry experience. We launched last month and are growing fast. We’re raising $500k to add 500 drivers and launch in New York City.

If you’re having a hard time removing information, keep in mind the purpose of the deck. The purpose is to help investors understand what you’re doing and get them excited enough to hop on a call — not to get them to invest right away — too much information can create confusion and an initial call may never happen.

Turning your story into a deck

Now that you have a good story:

Pull out each sentence and put it as the header of each slide.

Find content to support the header on each slide.

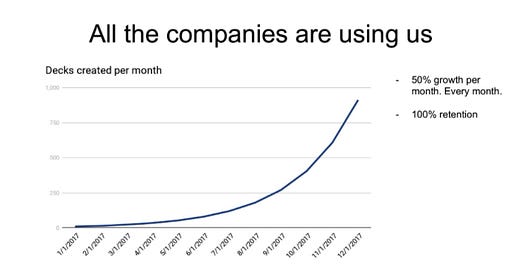

For example, if the slide header says, “We launched last month and are growing fast” the body of the slide should have a graph of revenue or user growth since launch. A big stat that summarizes the data would help, like “20% Month-over-month growth”.

I’d recommend keeping the deck to 10 slides max and only have one main point for each slide. The YC Seed Deck Template is a good reference and here is an interesting analysis of successful startup pitch decks. Keep in mind most of these may be a bit beyond Pre-Seed so they are more comprehensive than what you need.

Who to send your deck to

To start this process, you should list out anyone who could help introduce you to investors. Your default should be adding people to this list, only removing people you are 100% confident that they don’t know people who may invest or may invest themselves.

To build your list, go through any places where you and your co-founder have contacts stored:

Gmail Contacts

LinkedIn

Company CRM

Your Phone Contacts

Mailing Lists

Twitter

Business cards you picked up at events

Next, put all the contact info in one place. I would recommend using Airtable to organize this data because it is cleaner than Google Sheets and easy to group data. You can also add in a date & time field for calls which allows you to view your calls on a calendar. The Airtable blocks also make it easy to create charts to track your performance.

As far as the initial data to input, I would start with fields for: first name, last name, email, organization, and notes. Separate first and last name so that it makes it easy to send bulk, but personalized emails.

But, I don’t have a “network”!

“I didn’t go to Stanford or work at Google — how am I supposed to know investors!?” For a while, I also thought that I didn’t have a network because I did not have a traditional startup background. In reality, though, if you’ve been going to startup events and getting to know founders, you probably have a lot more people in your network than you think that can be helpful. Founders, especially those that have raised funding, are often going to be your best source for high-quality intros.

“Your network is at the heart of a successful investment strategy and without this, there’s no possibility of raising investment.” — Sophia Sunwoo

You can also find and reach out to anyone with the internet—search AngelList, LinkedIn, Crunchbase. Listen to podcasts and email the hosts and guests. Go to virtual events, in-person events, meetups, and pitch competitions. Look through alumni, Slack, and company directories. If you find someone interesting, research them some more and send them a concise email with a specific ask. You’ll be surprised at who responds.

If you’re coming from a non-traditional background, I would recommend building these relationships sooner rather than later. If you wait until it’s time to fundraise, it is going to be more difficult.

Research and rank

Once you have your list, start to go through and research each of the contacts to learn more about them. The goal is to identify who will be most likely to invest or introduce you to investors. Google every person, look them up on Twitter, Crunchbase, AngelList, and LinkedIn. Even if you think that you already know them well, it never hurts to spend a little extra time seeing if they’ve recently tweeted something, for example, that could be a good tie-in for your company.

Specifically, for investors, you’re looking to answer questions like:

Are they actively investing? When was their last investment?

What stage of company do they like to invest in?

Have they invested in companies in your industry or related to what you’re doing?

Do you have any personal connections with them?

Now go through and categorize them into likely investors and likely intros to investors (ie founders or advisors). For the investors, rank them on a high, medium, and low scale for whether they are likely to invest or not based on the above questions. The three key factors you’re looking for are stage, relationship, and industry — the greater the overlap, the more likely they are to invest.

Putting it all together

Now that you have your deck and your ranked list of intros and potential investors, we’re ready for the next step. You’re now going to start asking for feedback on your deck — not an investment. This works well because it invites genuine feedback and doesn’t take much time on their part.

Get initial feedback. From the list that you created, start with people other than investors. Ask them if they would be willing to provide feedback on your deck and if they say yes, send it their way. In particular, founders who have recently raised I’ve found to be the most helpful. Keep iterating your deck and pitch. You’ll know you’re making progress when the feedback becomes less substantive and more subjective.

Test it out on less ideal investors. Go to investors who are good investors, but don’t invest at your stage or industry. Go to pitch competitions to practice giving your pitch and get feedback.

Go after your high-value targets. Now that your pitch is honed and you have compelling but simple answers to common questions start going after the high-value targets — the people who invest in your stage and industry and know you.

Go for the close. If they like the idea, ask some questions to qualify if they invest, for example: Have you made investments in the past? When was your last investment? What did you like about that company? What do you look for in companies? If it seems like a good fit, ask them if they would consider investing. Don’t optimize for valuation; ask what they think is fair, but you should have some number in mind based on the earlier article. If they haven’t invested using a SAFE before, ask if they have any questions about the SAFE (note: make sure you understand and can articulate what a SAFE is).

A few tips

If they pass, but you seemed to have a good connection with them, ask if they’d like to be included in your Business Update emails. Sometimes the timing may just not be right or when they see that you’ve continued making progress on the company and the raise, they’ll be impressed and want to invest.

If someone seems like they like the idea at any stage, but they don’t invest at your stage, ask if they know of anyone who would be good to talk to. Send them a good Forward-Intro email with your deck attached.

The deck refinement process is iterative, so don’t worry about trying to have a “finished” deck because you never will. Keep taking feedback and constantly making it better until it starts closing deals.

I wouldn’t average advice or treat all advice equally. I would heavily weight the advice of founders who’ve recently raised pre-seed rounds and investors who invest pre-seed. Some people will be flat-out wrong and you should ignore their advice altogether. Especially people adjacent to the startup world, but aren’t actually recent founders or investors in tech startups.

Closing Thoughts

I used this approach, and it worked well, especially early on when our pitch deck sucked, and I thought I didn’t know any investors. But over time, we made progress. The deck improved, the intros improved, my ability to tell our story improved, and my ability to answer questions improved. This created a compounding effect. We went from no money raised to an oversubscribed round.

Continue Reading → Part 4: How to Find More Investors