Why SoftBank Won’t Raise Vision Fund II

VCs that forget they’re a marketplace, do so at their peril

Companies on one side.

Money on the other.

20% commission.

If that sounds like a marketplace to you — that’s because it is. Just like many of the business models they fund, venture capitalists are also marketplaces. It behooves venture capitalists to understand marketplace fundamentals as they are inherently marketplaces.

Why Venture Capital is inherently a marketplace

Each year there are thousands of new companies looking to raise venture capital and there are probably even more sources of capital interested in investing.

For investors (LPs) discovering the right company at the right time requires spending lots of time getting to know startups, becoming skilled at investing in startups, following industry trends, and building a brand that attracts high-caliber startups. Without VC, investors would also end up making riskier investments because their risk wouldn’t be distributed across numerous companies. The 20% commission VCs charge is probably a great deal!

For early-stage startups, the challenge of finding funding is often just as difficult. Without VC, early-stage startups would have to go and find individual investors interested in their sector, willing to take a risk early on, and able to write a large enough check. Angel Investors can often provide this for a startup’s first raise, but startups quickly need more money than most individuals can provide. Most individual investors also don’t invest full-time, so they are less likely to have the expertise or connections that are often critical to the success of early-stage startups.

VCs fill this void by solving the fundamental marketplace discovery use case of suppliers needing to find buyers and buyers needing to find suppliers. They also provide additional services and connections that increase the probability of their portfolio companies winning, but the discovery is often the most valuable.

Marketplaces and fragmentation

One of the key factors in a successful marketplace is the degree of fragmentation on both sides. High fragmentation matters because marketplaces can create more value by helping participants discover one another. Successful marketplace investor Bill Gurley lists high fragmentation as #4 on his list of 10 factors to consider when evaluating a marketplace. He states:

High buyer and supplier fragmentation is a huge positive for an online marketplace. Likewise, a concentrated supplier (or purchaser) base greatly diminishes the likelihood of a successful online marketplace. A highly concentrated supplier base will be reluctant to allow a new intermediary in their market, and as a result will likely fight rather than support your arrival. They will also be very reluctant to share in the economics of the industry, as anyone in the online travel industry can confirm. The large airlines have all but obliterated the economics of online ticketing marketplaces, leading all the online players to focus on hotels where the fragmentation and therefore the economics are higher. If you look at the list above of successful Benchmark investments, you will see a common theme of fragmented supplier base.

VC firm NFX also lists high fragmentation on its marketplace scorecard and provides this simple diagram to illustrate their point.

NFX’s goes on to describe:

We typically look for high fragmentation of both supply and demand, meaning with many hundreds or more of suppliers, and many thousands or more buyers, there are not a few dominant players on either side. The high fragmentation indicates high competition, so the players will be encouraged to use the marketplace to compete with each other. Low fragmentation means the opposite. The powerful players on either side will leverage their market power to keep the marketplace from getting traction or disintermediating or multi-tenanting over time. Plus if there is a player on either side who is too powerful, their defection from the marketplace can cripple a marketplace.

So marketplaces need fragmentation. It makes sense. If there is less fragmentation, there is less need for a marketplace as supply and demand already know where to go and are unwilling to pay an intermediary. However, one of the mistakes marketplace founders make is to chase the higher dollar transactions, more money = more money… right?! However, in going after higher dollar transactions, there is often less fragmentation.

In higher dollar transactions, there tend to be fewer participants with that much money and thus less fragmentation. For example, my startup is a marketplace and we deliberately focus on smaller transactions where there are more participants, more fragmentation, and thus more value that a marketplace can create. However, this is not immediately intuitive that there is often more money for marketplaces in smaller transactions.

VCs and fragmentation

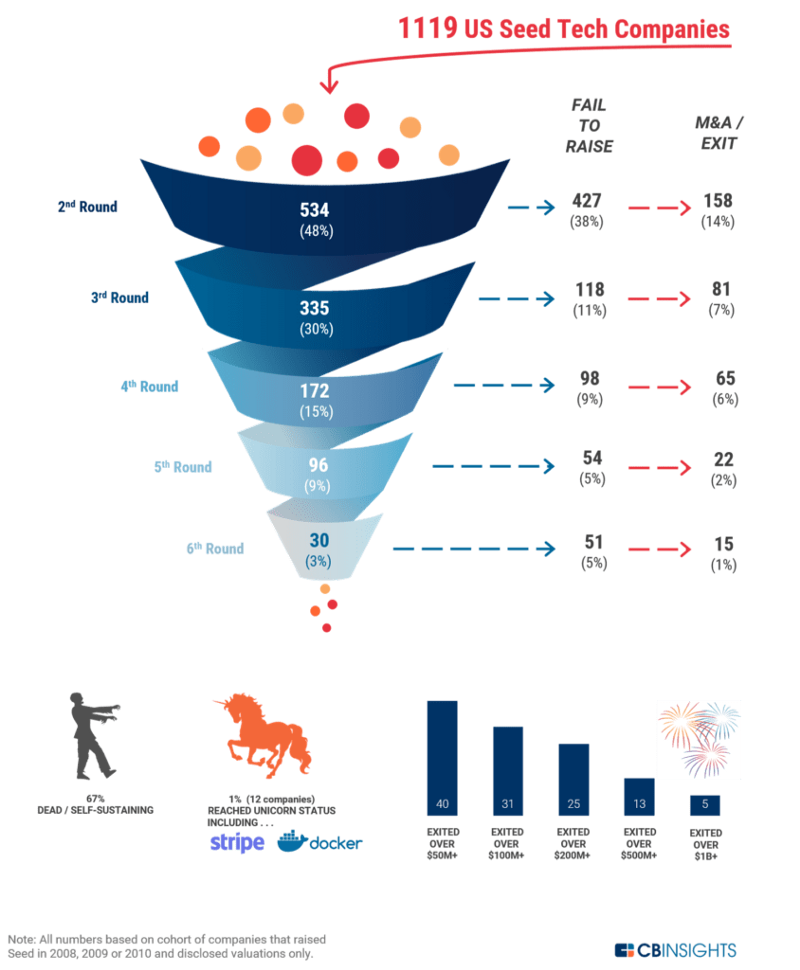

Fortunately for VCs early-stage startups are highly fragmented with no dominant player. However, as the rounds increase, the degree of fragmentation goes down dramatically from thousands to hundreds to dozens (see below).

Now, let’s talk about SoftBank

SoftBank seems to have made the mistake that many marketplace founders make. They thought there was more money in the big transactions. But, in doing so, they moved to a market segment (unicorns) with low fragmentation on the demand side where they have less opportunity to create value. The Vision Fund also suffered from low fragmentation on the supply side which was anchored by a dozen or so big contributions and Saudi Arabia’s $45B contribution accounted for almost half the fund.

Our theory seems to be holding as they are reportedly having issues raising Vision Fund II and unsurprisingly one of the main complaints from the LPs is a direct result of the lack of fragmentation at the high end of the market:

Many of the biggest funds already have established programs to invest directly in late-stage startups and aren’t interested in paying fees to another party, people close to them said.

By raising such a large fund and going after such large deals there are only a small number of companies that need that sort of money. Those companies are relatively well known and with the internet, very easy to find. There are also few LPs willing to invest checks of that size in tech startups. They can relatively easily find each other without needing to pay Masayoshi’s rake.