In 2020, Is Silicon Valley Still the Best Place to Start a Startup?

This time it’s (not) different

If you’re doom scrolling through VC Twitter these days, it’s easy to come to the conclusion that Silicon Valley is dead and gone.

Especially, if you’re a founder reading these tweets and articles, it’s easy to conclude that it’s no longer a good idea to start a startup in Silicon Valley. “Silicon Valley, America’s signature hub of innovation, may never be the same.” The Wall Street Journal concludes.

But, reading these articles made me think, haven’t we been here before? And sure enough, we have!

We’ve been here before

2009, Wall Street Journal

Did I wake up this morning in 2002? A story in today’s WSJ chronicles the rapid demise of high-tech start-ups in Silicon Valley…

2011, The Economist

SOME time after the dotcom boom turned into a spectacular bust in 2000, bumper stickers began appearing in Silicon Valley imploring: “Please God, just one more bubble.” That wish has now been granted.

2018, New York Times

Steve Case, the founder of AOL, has pledged to invest mostly in start-ups outside the Bay Area, saying that “we’ve probably hit peak Silicon Valley.”

2018, The Economist

Silicon Plateau — First, the evidence that something is changing. Last year more Americans left the county of San Francisco than arrived. According to a recent survey, 46% of respondents say they plan to leave the Bay Area in the next few years, up from 34% in 2016. So many startups are branching out into new places that the trend has a name, “Off Silicon Valleying”.

So is this time actually different and should you steer clear of founding a startup in Silicon Valley?

On one hand, you could choose to think that this time is different and there is data to suggest that. For example, a Zillow report in August of 2020 found, “…the San Francisco metro area does break the mold. Higher levels of inventory, up 96% YoY following a flood of new listings during the pandemic.”

But, looking at the past data and the many incorrect bubble calls, it is much more likely that this time is not different. For over two decades now, these bubble calls have yet to materialize (of course except for the dot com bubble). From future unicorn lists, to new IPOs to new mega-cap companies — Silicon Valley companies continue to dominate.

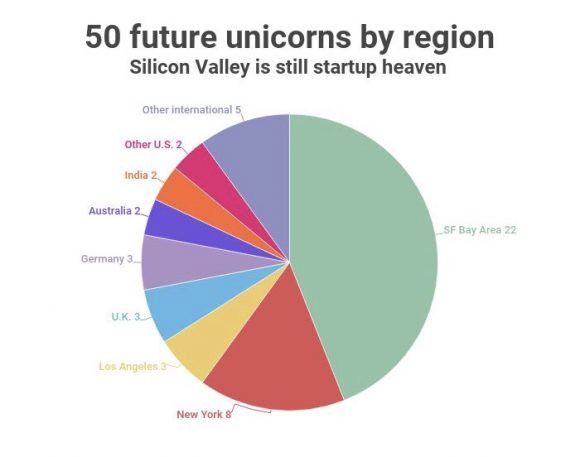

In June of 2020 for example, CB Insights and Fast Company published an updated future unicorn list and not much has changed. 44% of the future unicorns they identified globally are in Silicon Valley. A place with about 3% of the US population and a drop in the bucket of the world population. That was still early on in the pandemic though, so we’ll see if there is a magical shift next year.

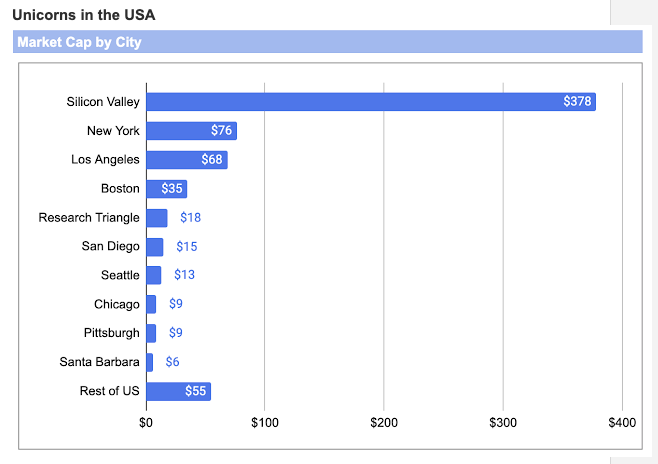

Prolific angel investor Elad Gil compiled data on unicorns in October of 2020 and found similar results. It’s worth noting that $46B of LA’s unicorn market cap comes from SpaceX. If this topic interests you, his article is worth reading in full along with the companion article he published last year.

This isn’t to say you can’t be successful elsewhere, you absolutely can, but often those success stories are outliers.

Will location even matter with remote-first companies?

Interestingly, Silicon Valley-based companies are leading the remote-first trend as Elad describes below.

Out of the top 100 private tech unicorns, 11 have perpetual “remote first” or “remote equal” policies. 5 of these were added since COVID. Interestingly, 4 of 5 (Affirm, Brex, Coinbase, Figma) of the unicorns who announced moving to remote-first forever post-COVID are all based in San Francisco, with 1 (Quora) based elsewhere in the Bay Area.

Given that roughly half the unicorns in the USA are based in the Bay Area, you would expect roughly half the unicorns going remote first to be based elsewhere. Instead all of them are in Silicon Valley (roughly a 1/32 chance if this were to happen randomly).

I do certainly think that fewer companies will have their entire teams based in Silicon Valley or any one place for that matter. However, I think founders will still gravitate towards Silicon Valley due to the unique network that is here.

Why Silicon Valley is and will continue to be the industry town for startups

Silicon Valley has created a marketplace for everything startups need. Talent, funding, startup lawyers, advisors looking to pay it forward, and more. The density of these unique participants is an order of magnitude greater than anywhere else. This density of participants makes connections more likely and promotes competition. The competition improves quality, weeds out bad actors, and decreases prices. All high-quality participants benefit from this dynamic, especially founders.

This phenomenon is a network effect. Network effects are very powerful because the product improves with each new customer. This makes it difficult for new entrants to attract customers because they can’t offer the same value as the incumbent. In this case, the ‘product’ is Silicon Valley and the ‘customers’ are the entrepreneurs, investors, and other participants. It’s the same reason film is to Hollywood what music is to Nashville.

So for now, I’ll be here in Silicon Valley, waiting for the next panic over the next “bubble”!